Luxury goods maker LVMH is boosting its presence in luxury hotel business with the acquisition of Belmond, the owner of hotels such as Venice’s landmark Cipriani, in a deal that is worth $3.2 billion including debt.

The aim of the deal is to increase its presence in upmarket hospitality segment, said LVMH while announcing the takeover decision. .

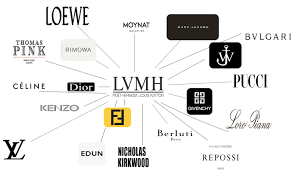

LVMH is the owners of the famous fashion brands such as Louis Vuitton and Christian Dior and already owns some hotels such as the Cheval Blanc in the prestigious Courchevel ski resort in the French Alps and the Bvgalri chain of hotels.

The company hopes that the deal would help it to further move deeper into the fast-growing “experiential” high-end travel and hospitality sector because the Belmond deal will make it the owner of some lucrative properties – which includes the only hotel within the Machu Picchu citadel in southern Peru, the Hotel Splendido in Portofino on the Italian riviera and the Copacabana Palace in Rio de Janeiro.

The company had earlier completed a series of deals in the luxury hotels sector which includes names such as the AccorHotels’ purchase of FRHI Holdings which is the parent company of the Fairmont and Raffles hotels.

“While some investors may question the acquisition, which appears to lie outside LVMH group’s core operations, we believe it is consistent with its long-term strategy focused on offering the consumer a full spectrum of luxury experience,” Berenberg analysts said in a research note.

LVMH has agreed to pay $25 per Belmond share which is a 40 per cent hike over the share’s Thursday’s closing price. It is expected that the deal would be closed in the first half of 2019 and the deal has put a value of $2.6 billion to Belmond’s equity, and $3.2 billion for that of the group, including debt.

In the 12 months to Sept. 30, Belmond reported earnings of $140 million before interest, taxes, depreciation and amortization (EBITDA) against revenue of $572 million.

While claiming that the price of the deal - at 5.6 times recent sales and 22.9 times recent EBITDA was apparently “optically high”, RBC Capital Markets analysts said “Belmond owns a unique portfolio of trophy real estate assets, that will allow LVMH to increase its exposure to experiential luxury”.

There are 46 luxury hotels, restaurants and train and river-cruise properties that Belmond either owns or partly owns or manages and all of them are situated in exotic and distinctive destinations in various parts of the world.

(Source:www.wsj.com)

The aim of the deal is to increase its presence in upmarket hospitality segment, said LVMH while announcing the takeover decision. .

LVMH is the owners of the famous fashion brands such as Louis Vuitton and Christian Dior and already owns some hotels such as the Cheval Blanc in the prestigious Courchevel ski resort in the French Alps and the Bvgalri chain of hotels.

The company hopes that the deal would help it to further move deeper into the fast-growing “experiential” high-end travel and hospitality sector because the Belmond deal will make it the owner of some lucrative properties – which includes the only hotel within the Machu Picchu citadel in southern Peru, the Hotel Splendido in Portofino on the Italian riviera and the Copacabana Palace in Rio de Janeiro.

The company had earlier completed a series of deals in the luxury hotels sector which includes names such as the AccorHotels’ purchase of FRHI Holdings which is the parent company of the Fairmont and Raffles hotels.

“While some investors may question the acquisition, which appears to lie outside LVMH group’s core operations, we believe it is consistent with its long-term strategy focused on offering the consumer a full spectrum of luxury experience,” Berenberg analysts said in a research note.

LVMH has agreed to pay $25 per Belmond share which is a 40 per cent hike over the share’s Thursday’s closing price. It is expected that the deal would be closed in the first half of 2019 and the deal has put a value of $2.6 billion to Belmond’s equity, and $3.2 billion for that of the group, including debt.

In the 12 months to Sept. 30, Belmond reported earnings of $140 million before interest, taxes, depreciation and amortization (EBITDA) against revenue of $572 million.

While claiming that the price of the deal - at 5.6 times recent sales and 22.9 times recent EBITDA was apparently “optically high”, RBC Capital Markets analysts said “Belmond owns a unique portfolio of trophy real estate assets, that will allow LVMH to increase its exposure to experiential luxury”.

There are 46 luxury hotels, restaurants and train and river-cruise properties that Belmond either owns or partly owns or manages and all of them are situated in exotic and distinctive destinations in various parts of the world.

(Source:www.wsj.com)