One of the common points of view on the Great Depression is that the Fed could not prevent the acute shortage of liquidity, what, eventually, caused the crisis. Senior economist of the Bank for International Settlements did not agree. On the contrary, he introduced a new concept of "financial flexibility".

It includes not only the liquidity surplus, but also its flow into emerging markets, as developed countries have too low key rates. Such a situation had been characteristic for the world economy on the eve of the Great Depression. The same thing happened recently.

Then

Established in 1920, the gold standard allowed all the world's central banks use government bonds in the US and the UK for international settlements. It made cross-border lending significantly easier. In particular, States were active to lend money to Latin American and Central European countries.

US investors had been received impressive yields with relatively low risk. But then, lending standards began to soften, which resulted in growing number of defaults, and on top of it, the Fed raised the rate in 1928. The dollar started returning home, so as not to risk abroad. Investors shifted the impressive amount of cache returned from developing countries into US stocks. This led to the stock markets overheating, and then to the notorious collapse.

By 1929, a reversal of capital flows and the fall in raw material prices had finally destabilized emerging markets (which were called "third countries" in that era devoid of political correctness). Mining companies fell into mass bankruptcy.

In 1930, several Latin American countries devalued, and soon announced a default on government bonds. Then the crisis spread to Austria and Germany. After that, crawled into the UK: London had been actively financing Austrian and German projects. Prospective loans quickly moved into the "bad" debt category. Britain tried to solve the problem by means of devaluation, but in 1931, the Fed raised the rate again in order to stop the outflow of gold. So began the global banking panic.

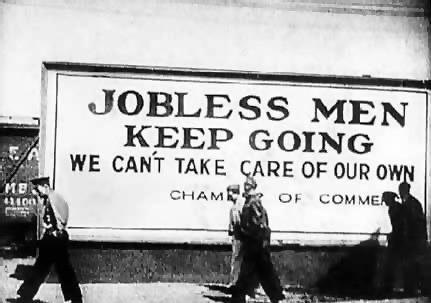

Most countries resorted to tight control of capital. Cross-border investment declined sharply, international trade slowed down along with them. Foreign government bonds on the balance sheets of many banks have become flimsy. Then, the legendary economist John Maynard Keynes said: "Let goods be homespun whenever it is reasonably and conveniently." The globalization was forgotten, and so started the era of protectionism.

Now

Let’s travel 86 years ahead to see a picture too similar to that described earlier. Low key rates of Fed, the ECB and the Bank of Japan prompted global investors to investing in China. However, the Fed began to raise rates, and capital began to go back.

In 2015, emerging markets have experienced first total capital outflow in almost 30 years. According to estimates of the World Bank for International Settlements, such dynamics can be preseved in the current year. Agencies downgraded the sovereign ratings of Brazil and South Africa. Commodity prices continue to fall.

The ghost of protectionism is hanging in the air again, despite all efforts of the WTO and other organizations. Europe and the United States have established protective tariffs on steel from China and Russia.

In 1930, there was at least a powerful natural limiter in the form of the gold standard. There’s no such thing today. Financiers’ violent fantasy is not limited by anything: a variety of derivatives markets is estimated at tens of trillions of dollars, and it is not clear already who owns whom. According to Claudio Borio, this is one of the elements of financial flexibility.

Senior economist of the Bank for International Settlements warns that all of this could end up with competitive devaluation, as it was between the two world wars. In the future, it is fraught with economic stagnation and excessive protectionism. Judging by the ECB’s hints at some new measures, the Fed's lack of confidence in a further increase, and by negative rates of the Bank of Japan, the world's regulators are about to trigger a backflash.

source: marketwatch.com

It includes not only the liquidity surplus, but also its flow into emerging markets, as developed countries have too low key rates. Such a situation had been characteristic for the world economy on the eve of the Great Depression. The same thing happened recently.

Then

Established in 1920, the gold standard allowed all the world's central banks use government bonds in the US and the UK for international settlements. It made cross-border lending significantly easier. In particular, States were active to lend money to Latin American and Central European countries.

US investors had been received impressive yields with relatively low risk. But then, lending standards began to soften, which resulted in growing number of defaults, and on top of it, the Fed raised the rate in 1928. The dollar started returning home, so as not to risk abroad. Investors shifted the impressive amount of cache returned from developing countries into US stocks. This led to the stock markets overheating, and then to the notorious collapse.

By 1929, a reversal of capital flows and the fall in raw material prices had finally destabilized emerging markets (which were called "third countries" in that era devoid of political correctness). Mining companies fell into mass bankruptcy.

In 1930, several Latin American countries devalued, and soon announced a default on government bonds. Then the crisis spread to Austria and Germany. After that, crawled into the UK: London had been actively financing Austrian and German projects. Prospective loans quickly moved into the "bad" debt category. Britain tried to solve the problem by means of devaluation, but in 1931, the Fed raised the rate again in order to stop the outflow of gold. So began the global banking panic.

Most countries resorted to tight control of capital. Cross-border investment declined sharply, international trade slowed down along with them. Foreign government bonds on the balance sheets of many banks have become flimsy. Then, the legendary economist John Maynard Keynes said: "Let goods be homespun whenever it is reasonably and conveniently." The globalization was forgotten, and so started the era of protectionism.

Now

Let’s travel 86 years ahead to see a picture too similar to that described earlier. Low key rates of Fed, the ECB and the Bank of Japan prompted global investors to investing in China. However, the Fed began to raise rates, and capital began to go back.

In 2015, emerging markets have experienced first total capital outflow in almost 30 years. According to estimates of the World Bank for International Settlements, such dynamics can be preseved in the current year. Agencies downgraded the sovereign ratings of Brazil and South Africa. Commodity prices continue to fall.

The ghost of protectionism is hanging in the air again, despite all efforts of the WTO and other organizations. Europe and the United States have established protective tariffs on steel from China and Russia.

In 1930, there was at least a powerful natural limiter in the form of the gold standard. There’s no such thing today. Financiers’ violent fantasy is not limited by anything: a variety of derivatives markets is estimated at tens of trillions of dollars, and it is not clear already who owns whom. According to Claudio Borio, this is one of the elements of financial flexibility.

Senior economist of the Bank for International Settlements warns that all of this could end up with competitive devaluation, as it was between the two world wars. In the future, it is fraught with economic stagnation and excessive protectionism. Judging by the ECB’s hints at some new measures, the Fed's lack of confidence in a further increase, and by negative rates of the Bank of Japan, the world's regulators are about to trigger a backflash.

source: marketwatch.com