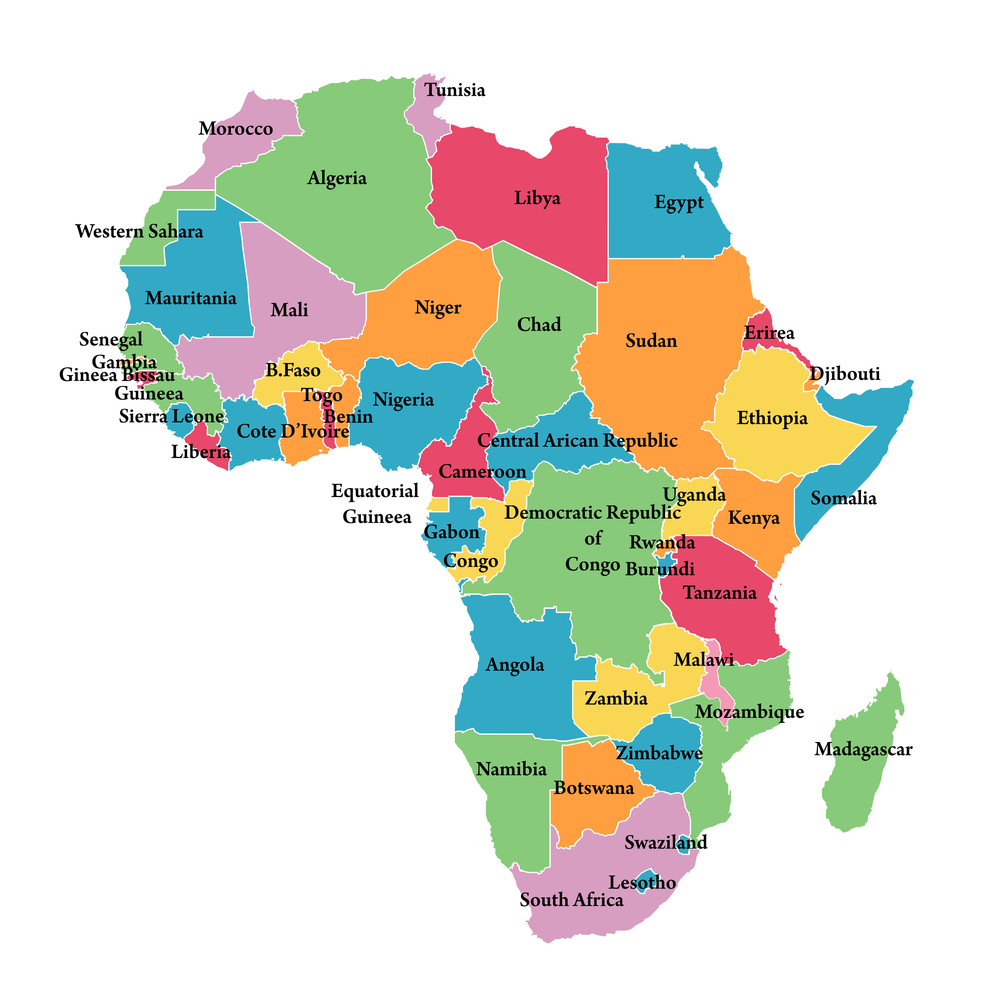

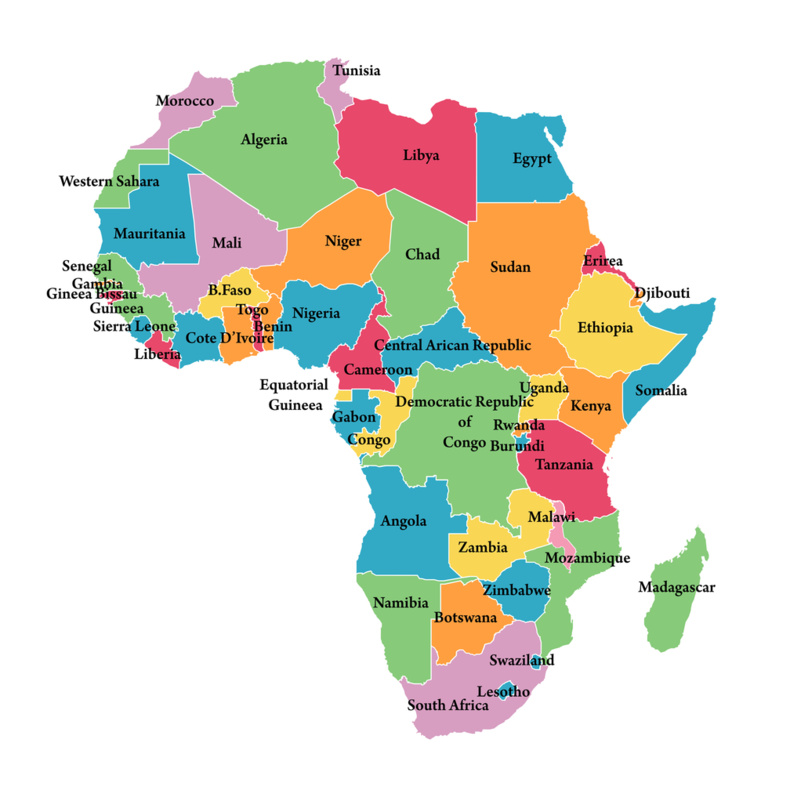

Resources at the disposal of each country may vary, but they are not non-existent. Oil-rich countries (such as Equatorial Guinea or Nigeria) possess GDP per capita levels comparable to rich European countries, while some of close-by neighbors drop to levels beneath 500 USD, but benefit international development assistance. The US government agency, USAID, reports details of its assistance to Ethiopia, one of the poorest nations on the continent: In the past five years, Ethiopia has experienced substantial growth in all three major economic sectors (agriculture, industry and services). However, investments by the private sector lag far behind those of government and the country continues to rank lowest in the region for the World Bank’s Ease of Doing Business Index. As a result, most African countries cannot self-fund their biggest projects and must rely on international investors.

The needs, however, are comprehensive: from basic infrastructures in the poorer countries to industrial upgrades in the richer. Those needs can be broken down into four categories : transport infrastructures, power supply, access to water, and technology transfers.

Technology transfers are essential to ensure that African countries can make their own development choices, independently of Western interests – a way in which China has not failed to notice. N.O. Agola, specialist of African development writes “Africa still remains the continent with the lowest level of technology deployment in all aspects of human productive and even leisurely activities. There is shockingly limited deployment of productive technology or capital equipment in production activities such as agriculture, fisheries, processing of basic products (foods items and clothing), construction and associated materials, and manufacturing of basic transportation equipment such as bicycles”. African countries which do possess technology can produce their own wealth, whereas those who don't are bound to spend what little wealth they have in acquiring goods from foreign countries.

Because power is so vital to all segments of industry, many projects are focusing on securing a steady supply of electricity to the land. To this day, only South Africa has been able to deploy nuclear reactors. However, much energy is left untapped and several major projects are underway to harness it. The Grand Inga Dam in the democratic republic of Congo is under feasibility study, representing an investment of 80 billion dollars, the largest dam ever built, and will deliver nearly 40 GW to the entire region. A smaller 6-GW dam is under construction on the Ethiopian Nile. Solar panel fields, such as the 238-MW Jasper field in South Africa will also contribute to powering the future industry. Bruce Khrog and Hedda Schmidtke, energy development experts for Smartgrid, describe the African power situation : “ Only 24 percent of the population of sub-Saharan Africa has access to electrical power, according to the World Bank, and many regions that do have power are plagued by rolling blackouts. Moreover, the problems of the oil-rich African countries are well known: Having energy resources does not necessarily translate into wide access to reliable energy.”

Reliable access to clean and safe water is also at the basis of the African strategy (or strategies, as each country/area has its own). Patrick Couzinet, Sales Director at Veolia Water Technology, recently posted as Director for the continent, explains: “water is such a basic element, needed for human and industrial applications, that water problems quickly contaminate everything down the chain: health issues, agricultural issues, manufactures on hold, everything. By transferring the water technology here, we can take part in the industrial development and attract even more foreign investors. If we fix the water issue, we fix all the rest”. The Africa Hartwood Project, an NGO specialized in access to clean water in Africa, confirms the centrality of the problem :”Because there is a lack of clean water in many rural villages in Africa, diseases transmitted through unclean water are a leading cause of preventable illness and premature deaths, with children being particularly vulnerable. According to the World Health Organization, nearly a million people die each year as a result of unsafe drinking water, with about half of those being children, whose deaths are preventable”. An economic plague waiting to be washed away.

Finally, the matter of transportation networks is essential, to enable the development of the industrial areas, and the free circulation of goods and people. The most notable project is the 3000-km railway beltway, under design of mining companies. Upon completion, it will link Benin, Burkina Faso, Niger, Ivory Coast, Ghana, Nigeria, and Togo in what should become a massive industrial area. Gareth Thomas, the British international development minister, stated “Africa's share of global trade fell from 6% to 2% between 1960 and 2002, and high transport costs are a major reason for this. Farmers and businesses operating in landlocked countries such as Zambia, Malawi and the Democratic Republic of the Congo face transport costs up to 50% higher than coastal countries.”

These projects are bound to be game-changers, wherever in Africa they are, or will be, taking place. But they will only be enabled by Foreign Direct Investment (FDI), as national resources are often insufficient to carry them alone. Fortunately for Sub Saharan Africa, the slump in FDI in North Africa gave way to a bump in FDI on the rest of the continent. Lee Mwiti reported for the World Economic forum “While foreign direct investment (FDI) globally fell 16% in 2014 from $1.47 trillion to $1.23 trillion, influenced by fragility in the world economy, policy uncertainty and geopolitical risks in some regions of Eurasia, in Africa FDI flows remained stable at $54 billion.” This suggests that investors believed in the solidity of these projects and will probably continue investing.

The needs, however, are comprehensive: from basic infrastructures in the poorer countries to industrial upgrades in the richer. Those needs can be broken down into four categories : transport infrastructures, power supply, access to water, and technology transfers.

Technology transfers are essential to ensure that African countries can make their own development choices, independently of Western interests – a way in which China has not failed to notice. N.O. Agola, specialist of African development writes “Africa still remains the continent with the lowest level of technology deployment in all aspects of human productive and even leisurely activities. There is shockingly limited deployment of productive technology or capital equipment in production activities such as agriculture, fisheries, processing of basic products (foods items and clothing), construction and associated materials, and manufacturing of basic transportation equipment such as bicycles”. African countries which do possess technology can produce their own wealth, whereas those who don't are bound to spend what little wealth they have in acquiring goods from foreign countries.

Because power is so vital to all segments of industry, many projects are focusing on securing a steady supply of electricity to the land. To this day, only South Africa has been able to deploy nuclear reactors. However, much energy is left untapped and several major projects are underway to harness it. The Grand Inga Dam in the democratic republic of Congo is under feasibility study, representing an investment of 80 billion dollars, the largest dam ever built, and will deliver nearly 40 GW to the entire region. A smaller 6-GW dam is under construction on the Ethiopian Nile. Solar panel fields, such as the 238-MW Jasper field in South Africa will also contribute to powering the future industry. Bruce Khrog and Hedda Schmidtke, energy development experts for Smartgrid, describe the African power situation : “ Only 24 percent of the population of sub-Saharan Africa has access to electrical power, according to the World Bank, and many regions that do have power are plagued by rolling blackouts. Moreover, the problems of the oil-rich African countries are well known: Having energy resources does not necessarily translate into wide access to reliable energy.”

Reliable access to clean and safe water is also at the basis of the African strategy (or strategies, as each country/area has its own). Patrick Couzinet, Sales Director at Veolia Water Technology, recently posted as Director for the continent, explains: “water is such a basic element, needed for human and industrial applications, that water problems quickly contaminate everything down the chain: health issues, agricultural issues, manufactures on hold, everything. By transferring the water technology here, we can take part in the industrial development and attract even more foreign investors. If we fix the water issue, we fix all the rest”. The Africa Hartwood Project, an NGO specialized in access to clean water in Africa, confirms the centrality of the problem :”Because there is a lack of clean water in many rural villages in Africa, diseases transmitted through unclean water are a leading cause of preventable illness and premature deaths, with children being particularly vulnerable. According to the World Health Organization, nearly a million people die each year as a result of unsafe drinking water, with about half of those being children, whose deaths are preventable”. An economic plague waiting to be washed away.

Finally, the matter of transportation networks is essential, to enable the development of the industrial areas, and the free circulation of goods and people. The most notable project is the 3000-km railway beltway, under design of mining companies. Upon completion, it will link Benin, Burkina Faso, Niger, Ivory Coast, Ghana, Nigeria, and Togo in what should become a massive industrial area. Gareth Thomas, the British international development minister, stated “Africa's share of global trade fell from 6% to 2% between 1960 and 2002, and high transport costs are a major reason for this. Farmers and businesses operating in landlocked countries such as Zambia, Malawi and the Democratic Republic of the Congo face transport costs up to 50% higher than coastal countries.”

These projects are bound to be game-changers, wherever in Africa they are, or will be, taking place. But they will only be enabled by Foreign Direct Investment (FDI), as national resources are often insufficient to carry them alone. Fortunately for Sub Saharan Africa, the slump in FDI in North Africa gave way to a bump in FDI on the rest of the continent. Lee Mwiti reported for the World Economic forum “While foreign direct investment (FDI) globally fell 16% in 2014 from $1.47 trillion to $1.23 trillion, influenced by fragility in the world economy, policy uncertainty and geopolitical risks in some regions of Eurasia, in Africa FDI flows remained stable at $54 billion.” This suggests that investors believed in the solidity of these projects and will probably continue investing.