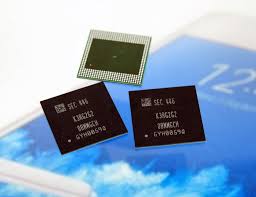

A global squeeze on supply of memory chips is threatened to be worsened as production lines are attempted to be kept running as Apple Inc's new iPhone 8 launch later this year and global electronics makers are scrambling to stock up on memory chips.

Industry sources and analysts say some electronics makers are paying a premium to lock into longer-term contracts even though heavyweights such as Apple and Samsung Electronics Co Ltd - which is also the world's top memory chip maker - will not be seriously hit.

In order to ensure that their perilously low inventories do no dry up completely, others are placing orders earlier than before.

"After the supply shortages emerged we brought forward our procurement decisions ... to ensure a stable supply," smartphone and personal computer maker LG Electronics Inc said in a statement, adding it had pushed up quarterly purchase decisions by about a month.

And raising investment costs yet providing less output growth as some suppliers struggle to improve yields, chip manufacturing technologies are growing increasingly complex. The result has been that some chip prices have doubled or tripled from a year earlier.

If they cannot get enough chips, the amount of NAND chips that are used for long-term data storage or of DRAM chips, which help devices perform multiple tasks at once, is being forced to cut down by device makers, some analysts say.

In order to make sure they get enough memory chips for their products, a handful of clients are accepting higher prices than the customary quarterly or monthly deals, as they have moved to 6-month supply agreements, a chip supplier source said.

"The problem will be more acute for the NAND market, where the iPhone remains a critical source of demand given the huge sales volumes and recent moves to increase storage capacity on the device," said the source, who declined to be identified as he was not authorized to speak publicly on the matter.

Significant variations in performance was accused on Huawei Technologies Ltd after it was discovered the Chinese firm used a mix of less advanced and powerful chips in its flagship P10 model which are signs that stress have already emerged.

On its memory procurement plans, there were no comments from Huawei.

Analysts say that apple buys about 18 percent of the global annual supply of NAND chips. In order to avoid being squeezed by Apple, which generally unveils its latest iPhone model in September, electronics makers have typically built up inventory during the first half in recent years.

But many have been left scrambling by the shortage of chips in the first half of the year.

Other companies could further be squeezed if there is a further increase the portion of high-storage models or should the U.S. giant opt to push out more iPhones than usual. Compared with the 82.3 million iPhone 7s that Cowen & Co. estimates for 2016, Apple could ship as many as 100 million new iPhone 8s this year, some analysts estimate.

"For the iPhone 8 launch there have been specific references to this by customers and distributors as a reason for longer delivery times and shortages," said Tobey Gonnerman, executive vice president at U.S.-based component distributor Fusion Worldwide.

"Buying buffer stock and holding product in hubs to protect against anticipated delivery interruptions has certainly become more common in recent months."

There were no comments from Apple on its memory chip purchasing plans.

Because of the shortage has been acute due to strong demand for high-end data storage products, chipmakers have been allocating more capital in recent years to boost production of NAND chips. While SK Hynix will start making its new high-end NAND products in coming months, Samsung Electronics will start NAND production at a $14 billion South Korea plant in the second half.

But meaningful new supply is unlikely to materialize until 2018, analysts say.

But noting its inventory levels were at an all-time low and unlikely to increase in the near-term given continued demand, SK Hynix told the media in a statement that it has been meeting delivery dates but acknowledged supply conditions were tight.

(Source:www.reuters.com)

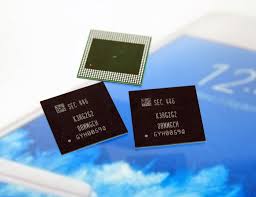

Industry sources and analysts say some electronics makers are paying a premium to lock into longer-term contracts even though heavyweights such as Apple and Samsung Electronics Co Ltd - which is also the world's top memory chip maker - will not be seriously hit.

In order to ensure that their perilously low inventories do no dry up completely, others are placing orders earlier than before.

"After the supply shortages emerged we brought forward our procurement decisions ... to ensure a stable supply," smartphone and personal computer maker LG Electronics Inc said in a statement, adding it had pushed up quarterly purchase decisions by about a month.

And raising investment costs yet providing less output growth as some suppliers struggle to improve yields, chip manufacturing technologies are growing increasingly complex. The result has been that some chip prices have doubled or tripled from a year earlier.

If they cannot get enough chips, the amount of NAND chips that are used for long-term data storage or of DRAM chips, which help devices perform multiple tasks at once, is being forced to cut down by device makers, some analysts say.

In order to make sure they get enough memory chips for their products, a handful of clients are accepting higher prices than the customary quarterly or monthly deals, as they have moved to 6-month supply agreements, a chip supplier source said.

"The problem will be more acute for the NAND market, where the iPhone remains a critical source of demand given the huge sales volumes and recent moves to increase storage capacity on the device," said the source, who declined to be identified as he was not authorized to speak publicly on the matter.

Significant variations in performance was accused on Huawei Technologies Ltd after it was discovered the Chinese firm used a mix of less advanced and powerful chips in its flagship P10 model which are signs that stress have already emerged.

On its memory procurement plans, there were no comments from Huawei.

Analysts say that apple buys about 18 percent of the global annual supply of NAND chips. In order to avoid being squeezed by Apple, which generally unveils its latest iPhone model in September, electronics makers have typically built up inventory during the first half in recent years.

But many have been left scrambling by the shortage of chips in the first half of the year.

Other companies could further be squeezed if there is a further increase the portion of high-storage models or should the U.S. giant opt to push out more iPhones than usual. Compared with the 82.3 million iPhone 7s that Cowen & Co. estimates for 2016, Apple could ship as many as 100 million new iPhone 8s this year, some analysts estimate.

"For the iPhone 8 launch there have been specific references to this by customers and distributors as a reason for longer delivery times and shortages," said Tobey Gonnerman, executive vice president at U.S.-based component distributor Fusion Worldwide.

"Buying buffer stock and holding product in hubs to protect against anticipated delivery interruptions has certainly become more common in recent months."

There were no comments from Apple on its memory chip purchasing plans.

Because of the shortage has been acute due to strong demand for high-end data storage products, chipmakers have been allocating more capital in recent years to boost production of NAND chips. While SK Hynix will start making its new high-end NAND products in coming months, Samsung Electronics will start NAND production at a $14 billion South Korea plant in the second half.

But meaningful new supply is unlikely to materialize until 2018, analysts say.

But noting its inventory levels were at an all-time low and unlikely to increase in the near-term given continued demand, SK Hynix told the media in a statement that it has been meeting delivery dates but acknowledged supply conditions were tight.

(Source:www.reuters.com)